Date:

The emergence of the internet in the 1990s marked a turning point in how we interact with our money. Everyday actions, such as checking a bank account balance or making an instant transfer—now routine—were revolutionary at the time, because information about investments and personal finance was exclusively in the hands of experts, advisors, and brokers.

Today, we are experiencing a shift of similar magnitude: in an increasingly technology-driven world, Artificial Intelligence (AI) is revolutionizing how we manage our money by facilitating access to digital tools that allow us to optimize our finances more effectively and intelligently.

According to a survey by BMO Financial Group, more than a third of Americans (37%) use Artificial Intelligence to manage their personal finances. What once required hours of planning and advice can now be accomplished in just a few seconds, and from the comfort of home. However, the adoption of these technologies also raises questions about the balance between automation and financial knowledge.

According to the survey, the most common uses people give to this technology are to learn more about finances, create and update household budgets, identify new investment strategies, accumulate savings, and develop or improve personalized financial plans. However, the benefit of incorporating this technology also lies in the use given by financial experts, who, by delegating routine tasks to algorithms, can focus on developing more inclusive, client-centered solutions. This, in turn, generates direct benefits for each individual’s financial health, as professionals can offer more personalized and strategic advice, merging human intuition and experience with the advanced data analysis provided by technology.

However, the fact that AI simplifies money management does not mean that learning the basics of finance is no longer necessary. In fact, a study by Junior Achievements revealed that 70% of young people consider financial and economic education as the most important subject they should receive in school. Understanding terms such as budget, savings, credit, and investment remains indispensable for acquiring a solid foundation that protects us and allows us to maintain control of our finances instead of delegating it entirely to algorithms. These skills are essential for developing good financial health, that is, the ability to efficiently and sustainably manage our resources over time.

Here lies the virtuous cycle between Artificial Intelligence and financial education: both feed into each other, creating a synergistic relationship in which, to achieve efficient use, one cannot thrive without the other. Promoting access to AI-based financial technologies demands that people understand the basic principles of money management. But, in turn, AI provides the financial education necessary for users to learn to efficiently manage their resources and achieve positive and sustainable financial health.

In many countries in Latin America, where economies are more unstable and opportunities more limited, taking advantage of this virtuous cycle represents a unique opportunity to drive social progress and democratize access to financial information. Today, technological innovation plays a central role, and it is precisely information that is at the heart of AI. Therefore, if used properly, financial education can become a transformative tool, with the power to build a more inclusive and economically fair society for everyone.

About the author:

Sofía Gancedo, Bachelor in Business Administration from the Universidad de San Andrés, Master in Economics from Eseade, and Co-Founder of Bricksave.

Author of the article:

Bachelor in Business Administration from the Universidad de San Andrés, Master in Economics from Eseade, and Co-Founder of Bricksave

Bachelor in Business Administration from the Universidad de San Andrés, Master in Economics from Eseade, and Co-Founder of Bricksave

Related Posts

News

A Year of Interviews and …

News

Also Sought by XP, Safra, …

News

According to VanEck’s

Most popular

ETF

Analysis by FlexFunds

Appointments

He Brings Three Decades of Experience in the Financial Sector

Markets

Investment Ideas

Business

FIAGROs’ Assets Under Management Take a Leap

News

Magazines

Opinion

Agenda

Style

Contributors

About us

Contact and Help

DEI dropped: Medical schools won't be graded on diversity amid federal, state crackdown – USA Today

Citing state crackdowns on diversity, equity and inclusion, the organization that accredits medical schools has dropped diversity as a measure of the quality of medical education.

The Liaison Committee on Medical Education on May 19 voted to eliminate diversity programs and partnerships as criteria when it grades the performance of medical schools that confer “MD” degrees to students.

The liaison committee said it acted because new and proposed state laws targeting diversity, equity and inclusion conflict with the accrediting body’s standards. Eliminating diversity standards would create “a single set of accreditation expectations with which all schools, regardless of their location and current legislative environment, must comply,” the liaison committee said in a statement.

A liaison committee spokesperson said the committee made the decision after “thoughtful and careful consideration and discussion.” Its two sponsoring organizations, the Association of American Medical Colleges and the American Medical Association, did not answer questions from USA TODAY.

The decision to target diversity is a setback in efforts to attract medical students of all backgrounds, said doctors who have worked to promote diversity.

Dr. Virginia Caine, an Indiana University professor of medicine, said it’s important for doctors to connect and communicate with different cultures.

“We’re just dumbfounded by this decision made by LCME,” said Caine, who serves as president of the National Medical Association, which represents Black physicians.

Caine said studies have shown that Black patients experience better health outcomes and engage more effectively when treated by Black physicians.

“We have such a rich and incredible history of talented Black physicians,” said Caine, the public health department director of Marion County, Indiana. “If we knock out the access before they even are entering medical schools or academic schools, we’re just going to be a nation that’s not as creative, not as innovative and not as successful.”

About 5.2% of the nation’s doctors in 2022 identified as Black, according to a physician workforce report by the Association of American Medical Colleges. That’s an improvement since 2019 when 2.6% of physicians identified as Black. Still, the share of Black doctors still doesn’t match the 13.7% in the overall population.

About 6.3% of physicians in 2022 identified as Hispanic, Latino or Spanish origin, which also significantly trails the overall population.

More than a half dozen states have enacted laws placing restrictions on diversity efforts at state institutions such as colleges and universities. Florida, for example, prohibits state institutions from giving preferential consideration for employment, admission, or promotion.

And after taking office for his second term, President Donald Trump issued an executive order to end diversity, equity and inclusion policies in the federal government and affirmative action in federal contracting.

To reflect its turn away from enforcing diversity standards at medical schools, the liaison committee said it’s updating guidance for academic years 2025-26 and 2026-27.

The liaison committee assigns survey teams to assess medical schools on a dozen standards for items such as leadership, curriculum, faculty and medical student selection, support and services.

Schools that previously got diversity-related citations − or those preparing for accreditation − won’t have to provide information on their diversity efforts, the liaison committee said.

The National Medical Association said the federal and state efforts to cut diversity, equity and inclusion is limiting access to medical education for the next generation of Black physicians.

Caine said the nation already has a physician shortage projected to worsen within 5 years when about 1 in 3 practicing physicians will reach retirement age.

“It’s important for everybody,” Caine said. All medical students “should have the ability to connect, to be open, to communicate with your patients. To do that, you have to have some level of understanding related to that culture.”

Dr. Osose Oboh knows how important it is to reduce bias and improve trust with patients.

Oboh graduated medical school from Michigan State University and completed an internal medicine residency at Johns Hopkins University. She now is completing a gastroenterology fellowship at the University of California, San Francisco.

Oboh said the federal and state crackdown on DEI – and the liaison committee’s response – is “disheartening.”

“There is an attack on something that is actually good,” Oboh said. “Diversity has been rebranded as giving unqualified folks opportunity, when in reality, it’s increasing exposure to qualified people.”

She said bias in a medical setting can surface both among patients and doctors. Oboh, who is Black, said she recently gave “bad news” to a Black patient’s family. She explained the diagnoses and next steps the medical team planned to take.

“They were so appreciative to receive it from me,” Oboh said. “They understood why we were taking the steps we’re taking and why we were going to do the interventions we were going to do. They felt like nobody else had explained it to them.”

Leave a Comment

Trump called for 100% tariff on foreign films a day after Jon Voight proposed ‘limited’ tariffs – The Guardian

Actor was assigned by Trump to come up with a plan to save Hollywood, but his proposal only included tariffs ‘in certain limited circumstances’

US president Donald Trump announced his 100% tariff on films “coming into our country produced in foreign lands” one day after meeting with actor Jon Voight to discuss his proposals to bring film production back to the US – which only suggested that tariffs could be used “in certain limited circumstances”.

The Midnight Cowboy and Heat actor, who was appointed a “special ambassador” to Hollywood by Trump, has been meeting with studios, streamers, unions and guilds for months to develop a plan to lure film and television productions back to the US. Production companies often seek more cost-effective locations or tax incentives in other countries such as Canada, Australia, the UK, New Zealand, Hungary, Italy and Spain.

On the weekend Voight and his manager and film producer Steven Paul met with Trump at Mar-A-Lago to deliver his “comprehensive plan” – just before Trump stunned the international film industry with the idea of a 100% tariff on all films “coming into our country produced in foreign lands”.

Only the topline details of Voight’s proposal were revealed on Monday, but the only mention of tariffs in the plan was that they could be used “in certain limited circumstances” – in contrast with Trump’s sweeping announcement. His main proposals involve federal tax incentives, changes to tax codes, co-production treaties with other countries, and infrastructure subsidies for theater owners, and production and post-production companies.

Hollywood productions are often filmed in countries such as Canada, Australia, the UK, New Zealand, Hungary, Italy and Spain in order to take advantage of local tax incentives, talent pools and landscapes that look geographically similar enough to stand in for more expensive US locations.

In a statement on Monday Voight said the White House was now “reviewing” his proposals.

“The President loves the entertainment business and this country, and he will help us make Hollywood great again,” Voight said. “We look forward to working with the administration, the unions, studios, and streamers to help form a plan to keep our industry healthy and bring more productions back to America.”

The White House walked back on Trump’s announcement afterwards, saying that “no final decisions on foreign film tariffs have been made”.

Film production in Los Angeles has declined almost 40% over the last decade, according to FilmLA. Not all of this business went overseas: other states such as New York and Georgia have long offered generous tax incentives to attract productions.

Reactions in Hollywood to Trump’s announcement have been varied, in the absence of detail; it remains unclear how it would be decided which films would qualify as “foreign”. Marvel’s new film Thunderbolts*, for instance, was mostly made in the US but included some shoots on location in Malaysia and a score recorded in London. The tariff would also not address the comparatively higher cost of shooting in the US.

US performers union Sag-Aftra seemed broadly positive, saying it “supports efforts to increase movie, television and streaming production in the US” and that it would “advocate for policies that strengthen our competitive position, accelerate economic growth and create good middle class jobs for American workers”.

The International Alliance of Theatrical Stage Employees (IATSE) called for a “balanced federal response”, with IATSE’s international president Matthew Loeb saying the crew union had “recommended that the Trump administration implement a federal film production tax incentive and other domestic tax provisions to level the playing field for American workers”, but that “any eventual trade policy must do no harm to our Canadian members – nor the industry overall.”

Australia has reacted with trepidation: the country has attracted US tent pole productions via various rebates, including the federal government’s 30% rebate for big-budget film projects shot in Australia. Just under half of the A$1.7bn spent on screen production in Australia during 2023-24 was on international productions.

Australia’s arts minster, Tony Burke, said he was monitoring the situation closely.

“Nobody should be under any doubt that we will be standing up unequivocally for the rights of the Australian screen industry,” Burke said.

In the UK, government officials and senior figures from Britain’s multibillion-pound production industry immediately made plans to discuss Trump’s threat, with some in the industry warning ministers that such a tariff could wipe out the UK film industry.

Voight, Mel Gibson and Sylvester Stallone were appointed by Trump to be “special ambassadors to Hollywood”, which the president has called a “great but very troubled place”.

Leave a Comment

Leave a Comment

Leave a Comment

The price you pay for an Obamacare plan could surge next year – Tampa Bay Times

MIAMI — Josefina Muralles works a part-time overnight shift as a receptionist at a Miami Beach condominium so that during the day she can care for her three kids, her aging mother, and her brother, who is paralyzed.

She helps her mother feed, bathe, and give medicine to her adult brother, Rodrigo Muralles, who has epilepsy and became disabled after contracting covid-19 in 2020.

“He lives because we feed him and take care of his personal needs,” said Josefina Muralles, 41. “He doesn’t say, ‘I need this or that.’ He has forgotten everything.”

Though her husband works full time, the arrangement means their household income is just above the federal poverty line — too high to qualify for Florida’s Medicaid program but low enough to make Muralles and her husband eligible for subsidized health insurance through the Affordable Care Act marketplace, also known as Obamacare.

Next year, Muralles said, she and her husband may not be able to afford that health insurance coverage, which has paid for her prescription blood thinners, cholesterol medication, and two surgeries, including one to treat a genetic disorder.

Extra subsidies put in place during the pandemic — which reduced the premiums Muralles and her husband paid by more than half, to $30 a month — are in place only through Dec. 31. Without enhanced subsidies, Affordable Care Act insurance premiums would rise by more than 75% on average, with bills for people in some states more than doubling, according to estimates from KFF, a health information nonprofit that includes KFF Health News.

Florida and Texas would be hit especially hard, as they have more people enrolled in the marketplace than other states. Some of their congressional districts alone, especially in South Florida, have more people signed up for Obamacare than entire states.

Like many of the more than 24 million Americans enrolled in the insurance marketplace this year, Muralles was unaware that the enhanced subsidies are slated to expire. She said she cannot afford a premium hike because inflation has already eaten into her household’s budget.

“The rent is going up,” she said. “The water bill is going up.”

Low-income enrollees like the Muralles couple would see the biggest percentage increases in premiums if enhanced subsidies expire.

Middle-income enrollees who earn more than four times the federal poverty line would no longer be eligible for subsidies at all. Those middle-income enrollees (who earn at least $62,600 for a single person in 2025) are disproportionately older, self-employed, and living in rural areas.

Julio Fuentes, president of the Florida State Hispanic Chamber of Commerce, said many of his organization’s members are small business owners who rely on Obamacare for health coverage.

Subscribe to our free DayStarter newsletter

Want more of our free, weekly newsletters in your inbox? Let’s get started.

“It’s either this or nothing,” he said.

The Congressional Budget Office estimated that letting the enhanced subsidies expire would, by 2034, increase the number of people without health insurance by 4.2 million. In tandem with changes to Medicaid in the House of Representatives’ reconciliation bill and the Trump administration’s proposed rules for the marketplace, including toughening income verification and shortening enrollment periods, it would increase the number of uninsured people by 16 million over that time period.

A study by the Urban Institute, a nonprofit think tank, found that Hispanic and Black people would see greater coverage losses than other groups if the extra subsidies lapse.

Fuentes noted that about 5 million Hispanics are enrolled in the ACA marketplace, and that Donald Trump won the Hispanic vote in Florida in 2024. He hopes the president and congressional Republicans see extending the enhanced subsidies as a way to hold on to those voters.

“This is probably a good way, or a good start, to possibly grow that base even more,” he said.

Enrollment in the marketplace has grown faster since 2020 in the states won by Trump in 2024. A recent KFF survey found that 45% of Americans who buy their own health insurance identify as or lean Republican, including 3 in 10 who identify as Make America Great Again supporters. Smaller shares identify as Democrats or Democratic-leaning independents (35%) or do not lean toward either party (20%).

Kush Desai, a White House spokesperson, said the rules proposed by the Trump administration, combined with the provisions in the House-passed budget bill, would “strengthen the ACA marketplace.” He noted that the CBO projects the legislation would reduce premiums for some plans about 12% on average by 2034 — but out-of-pocket costs would rise or remain the same for most subsidized ACA consumers.

“Democrats know Americans broadly support ending waste, fraud, and abuse, as The One, Big, Beautiful Bill does, which is why they are desperately trying to change the conversation,” Desai said.

But Lauren Aronson, executive director of Keep Americans Covered, a group in Washington, D.C., representing health insurers, hospitals, physicians, and patient advocates, said it is critical to raise awareness about the likely impact of losing the enhanced subsidies, which are also known as advanced premium tax credits. She is encouraged that Democrats have proposed legislation to extend the enhanced tax credits, and that some Republican senators have voiced support.

What worries Aronson most is that the Republican-controlled Congress is more focused on extending tax cuts than enhanced subsidies, she said. The current bill extending the 2017 tax cuts would increase the federal deficit by about $2.4 trillion over the next decade, according to the CBO, while making the enhanced subsidies permanent would increase the deficit by $358 billion over roughly the same period.

“Congress is moving forward on a tax reconciliation package that purports to benefit working families,” Aronson said. “But if you don’t take care of the tax credits, working families will be left holding the bag.”

Brian Blase, president of Paragon Health Institute, a conservative health policy think tank, said the enhanced subsidies were supposed to be a temporary measure during the covid-19 pandemic to help people at risk of losing coverage.

Instead, he said, the enhanced subsidies facilitated fraud because enrollees did not need to verify their income eligibility to receive zero-premium plans if they reported incomes at or near the federal poverty level.

The enhanced subsidies also worsen health inflation, discourage employers from offering health insurance benefits, and crowd out alternative models, such as short-term insurance and Farm Bureau plans, Blase said.

“Permitting these subsidies to expire would just be going back to Obamacare as it was written,” Blase said. “That is a more efficient program than the program that we have now.”

New rules for the marketplace proposed by the Trump administration in March are already designed to address fraud, said Anna Howard, a policy expert with the American Cancer Society Cancer Action Network, which advocates for increased health insurance coverage. Howard said extending the enhanced tax credits would help ensure that people who are legitimately eligible for coverage can get it.

“We don’t want to see over 5 million people be kicked off their health insurance coverage out of fears of fraud when the policies being proposed don’t necessarily address fraud,” she said.

Without affordable premiums, many consumers will turn to short-term health plans, health care cost-sharing ministries, and other forms of coverage that do not have the benefits or protections of the health law, she said.

“These are plans that don’t provide coverage for prescription drugs, or they have lifetime and annual limits,” she said. “For a cancer patient, those plans don’t work.”

Though the enhanced subsidies do not expire until the end of the year, the Blue Cross Blue Shield Association would prefer Congress to act by fall to avoid confusion during open enrollment, said David Merritt, a senior vice president. Insurers are preparing rates to meet state deadlines. By October, consumers will receive 60-day plan renewal notices with their 2026 premiums.

Without enhanced subsidies, Merritt said, competition in the marketplace will wither, leading to fewer coverage options and higher prices, especially in states that have not expanded Medicaid eligibility and where Obamacare enrollment spiked during the past four years, like Florida and Texas. “Voters and patients are really going to see the impact,” he said.

Republican and Democratic representatives for some of the Florida congressional districts with the highest numbers of people in the marketplace did not respond to repeated interview requests.

Muralles, of North Miami, Florida, said she wants her representatives to work in the interest of constituents like herself, who need health insurance coverage to care for their families.

“Now is the time to prove to us that they are with us,” Muralles said. “When everybody’s healthy, everybody goes to work, everybody can pay taxes, everybody can have a better life.”

***

KFF Health News is a national newsroom that produces in-depth journalism about health issues. Together with policy analysis and polling, KFF Health News is one of the three major operating programs at KFF. KFF is an endowed nonprofit organization providing information on health issues to the nation.

Anyone can view a sampling of recent comments, but you must be a Times subscriber to contribute. Log in above or subscribe here.

Conversations are opinions of our readers and are subject to the Community Guidelines.

The Tampa Bay Times e-Newspaper is a digital replica of the printed paper seven days a week that is available to read on desktop, mobile, and our app for subscribers only. To enjoy the e-Newspaper every day, please subscribe.

Leave a Comment

Indian students reconsider US plans amid visa uncertainties – BBC

When 26-year-old Umar Sofi received his acceptance letter from Columbia University's School of Journalism, he thought the hardest part of his journey was over.

After trying for three years, Mr Sofi had finally been admitted to his dream university and even secured a partial scholarship. He quit his job in anticipation of the big move.

But on 27 May, when the US suddenly paused student visa appointments, the ground slipped from beneath his feet.

"I was numb. I could not process what had happened," Mr Sofi, who lives in Indian-administered Kashmir, told the BBC.

Some 2,000km (1,242 miles) away in Mumbai, 17-year-old Samita Garg (name changed on request) went through a similar ordeal.

A day after she was accepted into a top US university to study biochemistry – her first step towards becoming a dermatologist – the US embassy halted student visa appointments.

"It is scary and stressful," Ms Garg told the BBC over the phone. "It feels like I've been left in the lurch, not knowing when this will end."

Both Mr Sofi and Ms Garg now have only a few weeks to secure their visas before the academic year begins in August, but little clarity on whether they can go ahead with their plans.

Last month President Donald Trump's administration asked US embassies across the world to stop scheduling appointments for student visas and expand social media vetting of applicants.

This wider move followed a crackdown on America's elite universities like Harvard, which Trump accused of being too liberal and of not doing enough to combat antisemitism.

Trump's decisions have had far-reaching repercussions in India, which sends more international students to the US than any other country.

Over the last month, the BBC spoke with at least 20 students at various stages of their application process, all of whom echoed deep anxieties about their futures. Most chose to remain anonymous, fearing retribution from the US government and worried that speaking out now could hurt their chances of obtaining a visa, or renewing it.

More than 1.1 million international students were enrolled in US colleges in the 2023-24 school year, according to Open Doors, an organisation that collects data on foreign students.

Nearly a third of them, or more than 330,000, were from India.

Educational consultants report that applications to US universities for the upcoming autumn semester have dropped by at least 30% because of the uncertainty.

"Their biggest fear is safety – what if their visas are rejected or they're deported mid-term?" said Naveen Chopra, founder of TC Global, an international education consultancy.

Experts say many students are now either deferring their plans or switching to countries perceived to be more "stable" like the UK, Germany, Ireland and Australia.

Prema Unni (name changed on request) was accepted into three US universities for a master's in data analytics. But instead of preparing for the move, he decided to forgo the opportunity altogether.

"There's uncertainty at every step – first the visa, then restrictions on internships and part-time work, and the constant surveillance while on campus," Mr Unni said. "It is very stressful."

The halt on visa interviews is the latest in a series of policies tightening immigration rules for students. A few weeks ago, the US warned that students who drop out or miss classes without proper notification risk having their visas revoked, and could be barred from future entry.

These decisions have come around the time of the year when 70% of student visas are issued, or renewed, sparking great unease among Indian students.

"No student wants to go to a country and then have the visa policy suddenly change," Chris R Glass, a professor at Boston College told the BBC. "They need stability and options."

The uncertainty will have long-term consequences – both for the aspirations of Indian students, but also for the US's future as a coveted higher education hub – says Prof Glass.

Foreign student enrolment in US universities was slowing even before Trump's latest salvo.

According to The Indian Express newspaper, the US denied 41% of student visa applications between the fiscal years 2023 and 2024, the highest rejection rate in a decade, and nearly doubling from 2014.

Data from Student and Exchange Visitor Information Systems (SEVIS), which tracks foreign students' compliance with their visas, showed a nearly 10% drop in international student enrolments as of March this year compared with the same period in 2024.

International students are a financial lifeline for many US colleges, especially regional and state universities offering STEM (Science, Technology, Engineering and Mathematics) and other master's programmes.

These students pay significantly higher tuition fees than US citizens.

In the 2023–24 academic year alone, foreign students contributed $43.8bn to the US economy, according to Nafsa, an association of International educators. They also supported over 375,000 jobs.

"This really isn't about a short-term disruption of tuition revenue. This is about a long-term rupture in a strategic relationship that benefits both countries," Prof Glass said.

For decades the brightest Indian students have depended on an American education in the absence of top quality Indian universities or a supportive research ecosystem.

In turn they've helped plug a skills gap in the US.

Many land highly sought-after jobs after they finish their courses – in particular, representing a significant pool of skilled professionals in sectors like biotechnology, healthcare and data science – and have even gone on to lead iconic companies.

Everyone from Google's Sunder Pichai to Microsoft's Satya Nadella went to the US as students.

While this has often led to concerns of a "brain-drain" from India, experts point out that India is simply unable to solve the problem of quality and quantity higher education in the immediate future to provide a domestic alternative to these students.

Experts say it will be a lose-lose situation for both countries, unless the cloud of uncertainty lifts soon.

Additional reporting by Divya Uppal, BBC India's YouTube team, in Delhi.

Follow BBC News India on Instagram, YouTube, Twitter and Facebook.

The justices rejected the argument that restrictions in a Tennessee law amounted to discrimination.

At least 30 US military planes have moved from bases in America to Europe, flight tracking data shows.

The parents and brother of Democratic state lawmaker Melissa Hortman spoke out for the first time since the shooting last week.

The exchange of fire continues as Donald Trump reportedly considers joining Israel's campaign against Iran.

England stick with Ollie Pope at number three rather than recalling Jacob Bethell for the first Test against India, starting on Friday.

Copyright 2025 BBC. All rights reserved. The BBC is not responsible for the content of external sites. Read about our approach to external linking.

Leave a Comment

Leave a Comment

Data Science Career Profile – corporatefinanceinstitute.com

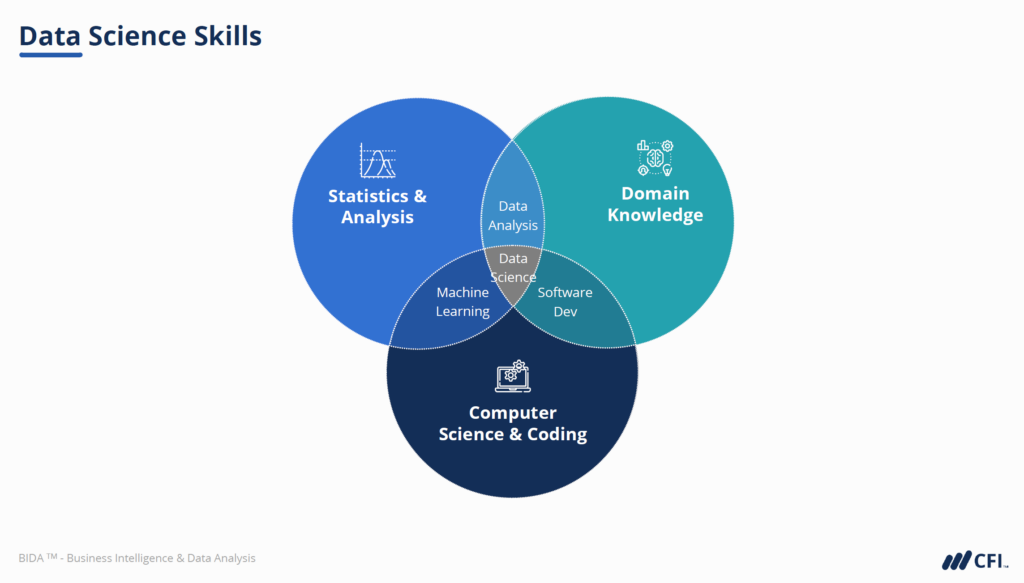

Data scientists analyze complex data sets using statistical methods, algorithms, and machine learning to uncover insights and support data-driven decision-making.

Data science is a multidisciplinary field that combines statistics, mathematics, computer science, and domain expertise to extract meaningful insights and knowledge from large amounts of structured and unstructured data. In the financial services industry, data science is crucial in helping organizations make informed decisions, mitigate risks, and drive innovation.

Data scientists within the financial services industry use advanced analytical techniques, machine learning algorithms, and statistical models to analyze complex financial data, predict market trends, detect fraud, and optimize business processes. They work with various data sources, including transaction records, market data, customer information, and economic indicators, to provide valuable insights that shape business strategies and improve operational efficiency and decision-making.

The demand for data scientists, particularly in the financial services industry, is exceptionally high and continues to grow rapidly. According to the 2023 U.S. Bureau of Labor Statistics, the job outlook for data scientists is projected to grow 36% by the year 2033 — which is much faster than the average growth rate for most other occupations.

The surge in demand for data scientists is driven by several factors, including:

Given these factors, individuals pursuing a career in data science within the financial services industry can expect a fruitful and rewarding career path with numerous opportunities for growth and advancement.

A career in data science encompasses a wide range of potential roles and responsibilities. While data scientists work across various industries, the financial services sector offers unique challenges and opportunities for those with the right credentials and specializations. There are several types of data science roles within finance, each focusing on different aspects of data analysis and application.

Here’s an overview of the three key roles of data scientists in the financial services industry:

A data science analyst, also commonly referred to as a data analyst (despite data analysis being a slightly different field), is often considered an entry-level position within the data science field. These professionals play a crucial role in interpreting financial data and translating it into actionable insights for business decisions.

The day-to-day responsibilities of a data science analyst in finance typically include:

Data scientists in the financial services industry are more advanced professionals who combine strong analytical skills with deep domain knowledge to solve complex problems and drive innovation.

Their day-to-day responsibilities often include:

Machine learning engineers specialize in developing and implementing machine learning fundamentals for models and algorithms. The financial services industry focuses on creating automated systems that can learn from experience and improve.

Their usual responsibilities include:

Choosing a career in data science within the context of the financial services industry can offer several advantages. More and more young professionals are considering this specific career path for the following reasons:

Overall, a career in data science within the financial services industry can be highly fulfilling. It offers analytical challenges, technological innovation, and the opportunity to significantly impact the industry — all of which keep these types of careers interesting and the professionals within them highly motivated.

To succeed in a data science career in the financial services industry, professionals need a combination of technical skills and industry-specific knowledge.

These are the skills normally required in data science careers:

The qualifications a data scientist should possess include the following:

A career in data science within the financial services industry can be highly fulfilling, offering a unique blend of analytical challenges and the opportunity to make a significant impact. However, like any career path, it comes with its own set of challenges and rewards.

Embarking on a career as a data scientist in the financial services industry requires a combination of education, skills development, and practical experience. If you’re interested in pursuing a career in financial services as a data scientist, these are the steps you’ll need to take:

Start by earning a bachelor’s degree in a relevant field such as data science, computer science, statistics, mathematics, or finance. Many positions in finance prefer or require an advanced degree, so consider pursuing a master’s or Ph.D. in data science or a related field down the road.

Focus on building strong programming skills, particularly in languages like Python, R, and SQL. Learn statistical analysis techniques and familiarize yourself with machine learning algorithms. It’s also a good idea to practice working with big data technologies and data visualization tools as much as possible.

Since you’ll be working within the financial services industry, you’ll also need to work on developing a solid understanding of financial concepts, markets, and regulations. This can be done through coursework, certifications, or self-study. Knowledge of financial modeling and risk assessment is not only valuable but is usually required in this field.

Get to work on data science projects that demonstrate your skills, particularly those relevant to finance. This could include analyzing stock market data, building predictive models for credit risk, or creating a fraud detection system. Be sure to create and track metrics for each project to demonstrate your capabilities and successes further.

Seek internships or entry-level positions in data analysis or financial services. This hands-on experience is crucial for understanding how data science is applied in real-world financial contexts. Whether you’re getting paid or interning for mentorship, having practical experience will bolster your resume and enable you to develop first-hand skills and knowledge as it is applied.

Attend industry conferences, join professional organizations, and participate in online communities to stay current with the latest trends and advancements in data science and finance. By staying connected with others in the industry, you’ll gain the advantage of learning about new opportunities and build a reputation for yourself among potential colleagues.

A career in data science within the financial services industry can offer a unique experience in applying advanced analytical skills to solve complex financial problems. With high demand, competitive salaries, and the chance to make a significant impact, it’s an attractive path for those with a passion for data and an interest in finance. While the journey requires dedication to continuous learning and skill development, the rewards can be substantial, both professionally and personally.

Are you ready to take the first step toward a career in data science? Browse CFI’s online data science courses and online certification program selection to get started on your data science career path. Whether you’re looking to build foundational skills or specialize in financial applications of data science, CFI offers a range of programs to help you achieve your career goals.

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Gain unlimited access to more than 250 productivity Templates, CFI’s full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in